Debunking IRMAA Appeal: Just How It Functions and What You Need to Know

The IRMAA appeal procedure can commonly appear daunting for Medicare beneficiaries facing unexpected premium increases. Comprehending the intricacies of IRMAA and its influence on costs is important. Many people may not realize they have the alternative to appeal these modifications. By exploring the factors behind these appeals and the necessary steps, beneficiaries can potentially alleviate their financial problem. What particular techniques can one use to browse this complicated system efficiently?

Recognizing IRMAA: What It Is and That It Impacts

IRMAA, or Income-Related Monthly Adjustment Amount, is an important part of Medicare's pricing framework that influences beneficiaries based upon their earnings levels. Introduced to ensure that higher-income individuals add even more to their medical care expenses, IRMAA customizes the standard premiums for Medicare Component B and Part D. Recipients with incomes over certain thresholds might encounter boosted costs, which can dramatically influence their general medical care expenses.

The change applies to couples and individuals, considering their customized adjusted gross revenue from two years prior. This means that those that might have experienced a decrease in income may still encounter greater costs based on previous profits. Recognizing IRMAA is crucial for beneficiaries as it can affect their financial planning and healthcare choices. Recognition of this adjustment assists individuals browse their Medicare options better, ensuring they are prepared for the potential prices linked with their coverage.

Just How IRMAA Is Computed: Earnings Thresholds and Modifications

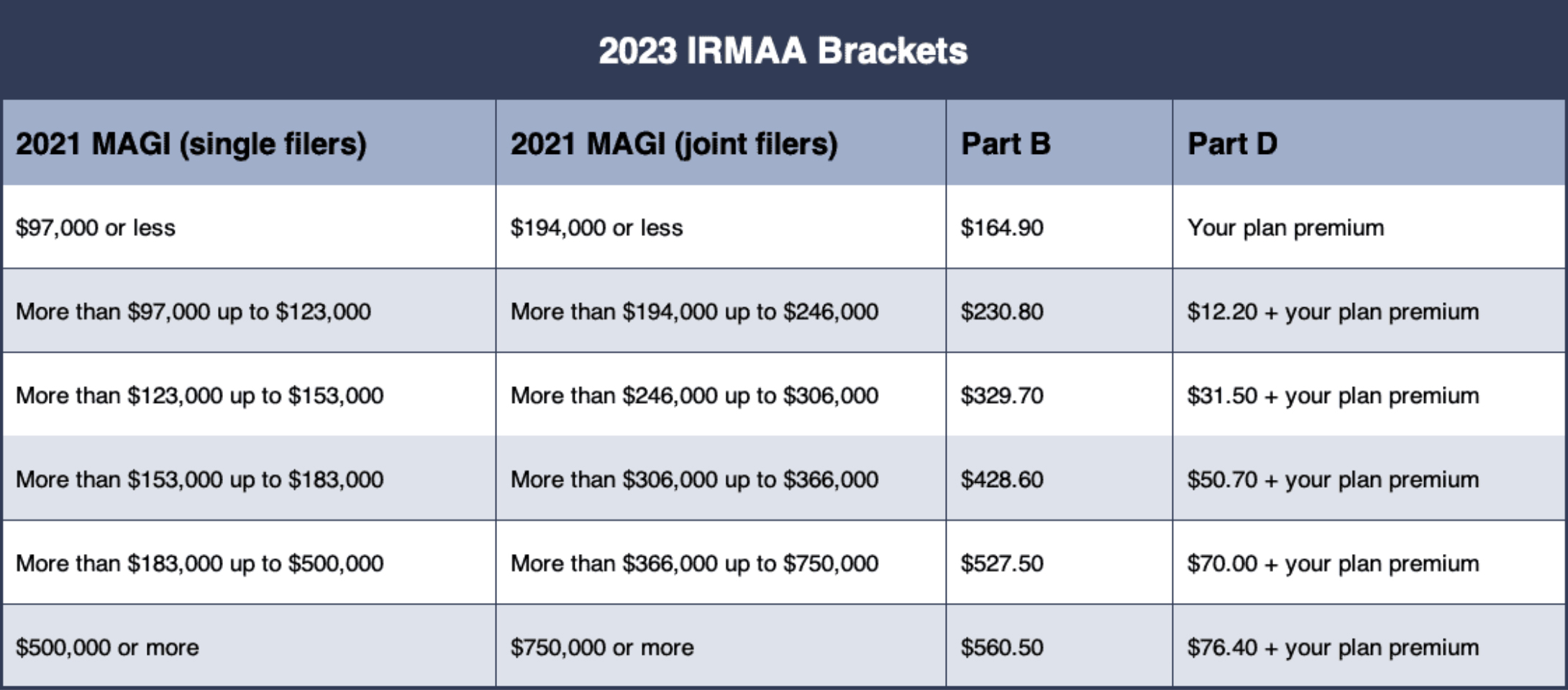

Calculating the Income-Related Month-to-month Modification Amount entails particular revenue thresholds that determine the added costs for Medicare recipients. The thresholds are changed yearly and are based on the beneficiary's customized adjusted gross earnings (MAGI) from two years prior. In 2023, individuals with a MAGI going beyond $97,000 and pairs going beyond $194,000 may sustain higher premiums.

The Income-Related Monthly Adjustment Amount is tiered, implying the premium raises as earnings surges. As an example, those with a MAGI in between $97,001 and $123,000 will pay a certain extra amount, while those going beyond $500,000 face the highest surcharges.

These modifications guarantee that higher-income beneficiaries contribute even more towards their Medicare costs. Comprehending these limits and changes can aid beneficiaries expect their costs and prepare their financial resources as necessary, ensuring they are not captured off guard by possible increases in their monthly Medicare costs.

Typical Reasons for IRMAA Appeals

Several recipients might find themselves dealing with an unforeseen IRMAA assessment, leading them to think about a charm. One common reason for such appeals is a considerable life change that impacts earnings, such as retirement or task loss. Recipients may argue that their existing earnings is less than what was reported to the internal revenue service, consequently validating a decrease in their IRMAA.

An additional constant factor entails inconsistencies in noted earnings, where individuals think that their income was incorrectly evaluated due to mistakes in tax returns or monetary documents. Additionally, some recipients may appeal based on special conditions, such as the fatality of a spouse or significant clinical expenses that have influenced their monetary situation. Recognizing these usual factors can empower beneficiaries to present a solid instance when navigating the IRMAA appeal procedure efficiently.

Step-by-Step Overview to the IRMAA Appeal Process

Navigating the IRMAA appeal process can be overwhelming, yet recognizing the actions entailed can simplify the journey. The very first step is to gather pertinent documentation, including tax returns and evidence of revenue adjustments. Next off, people should finish the appeal kind, which can usually be located on the Social Protection Administration (SSA) web site. This form must be sent within 60 days of obtaining the IRMAA determination notice.

As soon as the appeal is filed, the SSA will examine the info given and might ask for additional documentation. It is necessary to keep duplicates of all sent materials for personal records. After the evaluation process, visite site the SSA will certainly release a choice, which will be interacted in writing. If the appeal is denied, individuals have the option to request a hearing prior to a management legislation judge. Throughout the procedure, maintaining organized records and adhering to timelines can substantially enhance the possibilities of an effective appeal.

Tips for an Effective Appeal: What You Required to Know

A thorough understanding of vital techniques can significantly improve the possibility of an effective IRMAA appeal. Initially, it is vital to collect detailed documents, consisting of tax obligation returns and any pertinent financial statements. This evidence sustains the insurance claim for a reduction in income-related monthly change quantities. Second, individuals ought to know the specific circumstances that get approved for an appeal, such as significant life changes-- retirement, impairment, or loss of earnings.

Third, sending the appeal within the stipulated duration is essential; missing deadlines can result in read review automatic denials. Furthermore, crafting a clear, succinct letter that lays out the reasons for the appeal can boost its effectiveness. Persistence is essential, as the testimonial process may take time. By adhering to these guidelines, individuals can considerably boost their possibilities of attaining a desirable result in their IRMAA appeal.

Regularly Asked Questions

Can I Appeal IRMAA Decisions Multiple Times?

If they provide brand-new proof or an adjustment in situations, individuals can appeal IRMAA decisions numerous times. Each appeal must be substantiated with appropriate documentation to support the demand for reconsideration of the resolution.

For how long Does the IRMAA Appeal Process Take?

Will My IRMAA Appeal Impact My Medicare Coverage?

The IRMAA appeal does not influence Medicare insurance coverage. It exclusively deals with income-related modifications to premiums. Beneficiaries maintain their coverage throughout the appeal process, guaranteeing continuity of clinical solutions while awaiting the result of the appeal.

Are There Any Costs Connected With Filing an Allure?

Filing an appeal usually does not sustain direct charges; nevertheless, connected expenses may emerge from essential documentation or lawful help - appealing irmaa. It is advisable to validate specific needs and possible costs with the pertinent Medicare workplace

Exactly how Will I Be Informed About the Appeal Decision?

Individuals will obtain notice concerning the appeal choice by means of mail. Click This Link The choice letter will certainly detail the outcome and give further guidelines if essential, ensuring that the person is informed about the following steps to take.

The IRMAA appeal process can typically seem intimidating for Medicare recipients facing unexpected costs increases. Lots of recipients might find themselves facing an unexpected IRMAA evaluation, leading them to think about an allure. Browsing the IRMAA appeal process can be daunting, but understanding the actions included can simplify the journey. People can appeal IRMAA choices several times if they supply brand-new evidence or a modification in conditions. The IRMAA appeal process commonly takes around 60 days from the date of entry.